2024 E-Insights Report

Household Debt-To-Income Ratio

Household Debt-To-Income Ratio

Trend Over Time

Competitive Position Trend

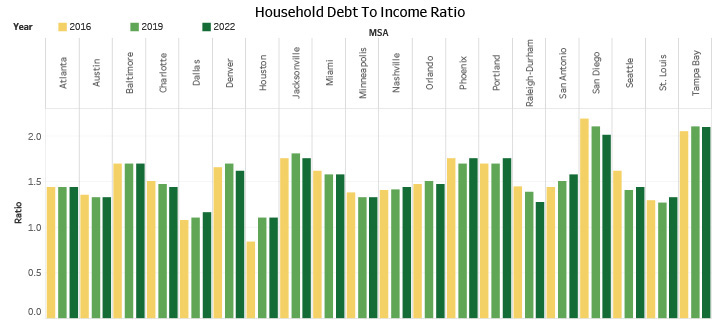

About: Measures the ratio of household debt arising from loans to the gross disposable income

earned by the individuals in that household.

Source: Board of Governors of the Federal Reserve System - Household Debt.

- Tampa overtook San Diego in 2019 to become the MSA with the highest household debt to income ratio. Houston and Dallas have had the lowest ratio over the years.

- Tampa Bay had a significantly high ratio over the last decade and resides in the bottom two positions.